1031 Exchange

Taxes are an inevitable part of investing in and selling real estate. You can, however, defer or avoid paying capital gains taxes by following some simple rules of a 1031 exchange.

1. What is a 1031 Exchange?

Simply put:

A 1031 Exchange, also known as a Section 1031 Exchange or a Like-Kind Exchange, is a portion of the US tax code that enables real estate investors to defer or postpone paying capital gain taxes following the sale of a business or investment property provided the proceeds are reinvested in a similar property under a like-kind exchange. These gains deferred under IRC Section 1031 are tax-deferred, and not to be confused with being tax-free.

A more technical explanation is:

An IRC §1031 tax-deferred exchange allows owners of real property to defer the recognition of a capital gains tax they would have recognized when they sold their property. Exchanging allows investors to reinvest money into new businesses or investment properties that would otherwise have been paid to the government as a capital gains tax. Tax-deferred exchanges are not new – they have been available in one form or another since 1921, and in its current format since 1986.In order to structure a transaction as an IRC §1031 tax deferred exchange a taxpayer would follow the steps contained in our Checklist. Simply put, an exchange is structured as a sale, just like any other sale, and a purchase, just like any other purchase, but with the inclusion of a qualified intermediary to structure the transaction as an exchange. It is very important to involve a qualified intermediary before you start your transaction. Without the involvement of a qualified intermediary before the sale of the relinquished property the proceeds become taxable and any proceeds used to acquire replacement property are with after-tax dollars.

2. What is a Qualified ‘Intermediary’?

A qualified intermediary is an independent third party to the transaction whose function is to prepare the documents necessary to create the exchange, as well as to act as the independent escrow agent for the exchange funds. The qualified intermediary is defined by the Treasury Regulations and may not give tax or legal advice. A qualified intermediary may not be a “disqualified person” as further defined in the Treasury Regulations. A disqualified person normally includes, but is not limited to, your attorney, CPA or accountant, realtor, agents, employees, relatives, and entities in which you have an interest. It is important to perform some due diligence when choosing a Qualified Intermediary to structure your transaction. We pride ourselves on our knowledge, customer services, and security of the 1031 exchange funds held in escrow for our clients.

3. What is ‘Like Kind’ property?

One of the most misunderstood concepts of tax-deferred exchanges is the concept of like kind. Many people wrongly believe that like kind means the same type of property must be purchased when completing an exchange. Nothing can be further from the truth. An Exchangers can sell one type of property and buy a completely different type of property as is explained below.

The relinquished property must be held for productive use in a trade or business, or for investment purposes, and be exchanged for property that is also to be held for productive use in a trade or business, or for investment purposes. IRC 1031(a)(1). However, real property can only be exchanged for real property. Although tax deferred exchanges are a creature of federal statute, it is state law that determines if a property is real. Reg. 1.1031(a)-1(b), (c), Aquilino v. United States, 363 U.S. 509 (1960). Furthermore, like kind only refers to the nature or character of the property, not to its grade or quality. Treas. Reg. 1.1031(a)-1(b).

What this means is that exchangers have the opportunity to purchase replacement property of any type. For example, an exchanger can sell vacant land and buy a strip mall; or sell an apartment building and buy a net leased property. Although §1031 exchanges are governed by federal law it is state law that determines what is and what is not real property. Therefore, exchanges of real estate interests such as air rights, easement, timber, conservation easements, and development rights may be possible. The graphic below illustrates how all property held for business or investment purposes is like kind to all other property held for business or

4. How do you identify property?

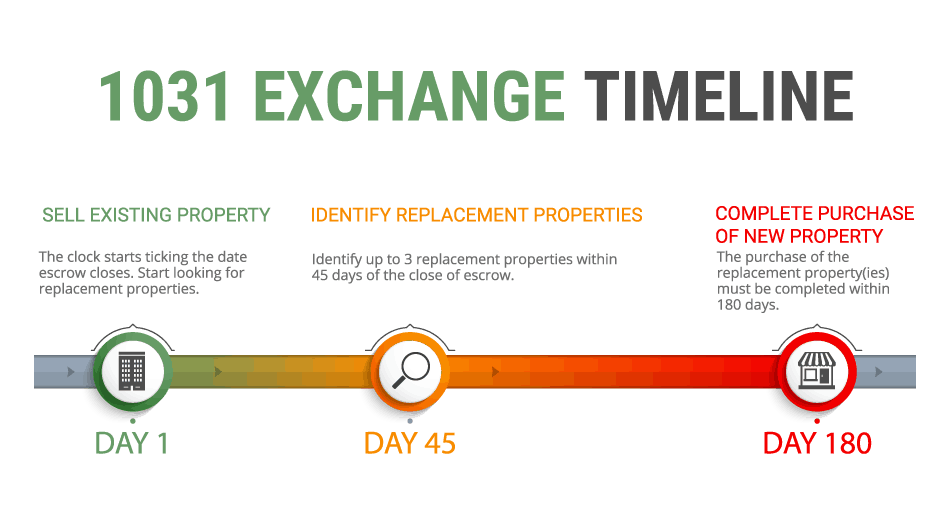

The Exchanger has 45 days from the date of the sale of the relinquished property to identify the potential replacement properties. The identification is a written letter or form which is signed and dated by the taxpayer and contains an unambiguous description of the property. A property which is identified is not required to be under contract or in escrow to qualify. Exchangers acquiring an undivided percentage interest (“fractional interest") in a property should identify the specific percentage that will be acquired.

The Exchanger may change the properties identified as often as it wants during the 45-day identification period by revoking the previously identified properties and then identifying new potential replacement properties. It is essential that the identification is delivered by midnight of the 45th day, or postmarked by the 45th day, to the Exchanger's Qualified Intermediary or to a party related to the exchange who is not a disqualified person. Typically, delivering the identification to the Qualified Intermediary is the safest course of action to prevent disqualification of the transaction for an invalid and/or untimely identification. If the Exchanger fails to deliver the identification in a timely fashion or does not comply with one of the three identification options, the exchange will be disallowed.

Unfortunately, there are restrictions on the number or value of the properties an exchanger identifies. To qualify for a 1031 exchange, the exchanger must comply with one of the following identification options:

Three Property Rule

- The "three property" identification rule allows an Exchanger to identify up to three replacement properties. There is no value limitation placed upon the prospective replacement properties and the exchanger can acquire one or more of the three properties as part of the exchange transaction. The "three property" rule is the most commonly used identification option, allowing an exchanger to identify fall back properties in the event the preferred replacement property can not be acquired.

200% Rule

-

The Exchanger can identify an unlimited number of properties, provided that the total value of the properties identified does not exceed 200% of the value of all relinquished properties. There is no limitation on the total number of potential replacement properties identified under this rule, only a limitation on the total fair market value of the identified properties.

For example, if an Exchanger sold relinquished property for $1,000,000 under the 200% rule, the Exchanger would be able to identify as many replacement properties as desired, provided the aggregate fair market value of all of the identified properties does not exceed $2,000,000 (200% of the $1,000,000 sales price of the relinquished property). 95% Exception Rule

-

The Exchanger may identify an unlimited number of replacement properties exceeding the 200% of fair market value rule, however the Exchanger must acquire at least 95% of the fair market value of the properties identified. This rule is utilized in limited circumstances as there is a much higher risk of the transaction failing.

For example, assume an Exchanger identifies ten properties of equal value. In order to satisfy the rule, the Exchanger would be required to acquire all ten identified properties within the exchange period to complete a successful exchange. If one of the properties fell through, the entire 1031 exchange would be disqualified because the exchanger did not acquire 95% of the fair market value identified. This rule should only be utilized in situations where there is a high level of certainty pertaining to the acquisition of the identified properties and the other two rules do not meet the Exchanger's objectives.

5. What is the structure of a delayed exchange?

An exchange is basically a sale just like any other sale and a purchase just like any other purchase, however, you must work with a qualified intermediary before you start your exchange.Tax deferred exchanges are normally structured as one of four variants: simultaneous, delayed [Treas. Reg. 1.1031(k)-1(a)], reverse [Revenue Procedure 2000-37], and build-to-suit. In the case of a simultaneous or delayed exchange, the exchanger first enters into a contract to sell the relinquished property or properties. Contrary to popular belief there is no “exchange contract” for a delayed exchange. The exchanger enters into a contract that they would normally use if they were not structuring the transaction as an exchange. However, the addition of an exchange cooperation clause is recommended to secure the cooperation of the buyer or seller of the relinquished property or replacement property, respectively.A person or entity that is not a disqualified party [Treas. Reg. 1.1031(k)-1(g)(4)(iii)], usually a Qualified Intermediary, thereafter assigns into the rights, but not the obligations of the contract. This assignment creates the legal fiction that the Qualified Intermediary is actually swapping one property for another. In reality, the exchanger sells the relinquished property and purchases the replacement property from whomever he or she wishes in an arms length transaction. There is absolutely no requirement that an exchanger actually “swap” properties with another party.In addition to the assignment of contract, there must be an exchange agreement entered into prior to the closing of the first property to be exchanged. The exchange agreement sets forth the rights and responsibilities of the exchanger and the entity acting as a qualified intermediary, and classifies the transactions as an exchange, rather than a sale and subsequent purchase. In addition, the exchange agreement must limit the exchanger’s rights “to receive, pledge, borrow, or otherwise obtain the benefits of money or other property before the end of the exchange period.” Treas. Reg. 1.1031(k)-1(g)(6). That is, the exchanger may only use the exchange funds to purchase new property, and to pay most expenses related to the sale and purchase of the properties.Once the exchange agreement and assignment of contract are executed, the exchanger sells the property; however instead of collecting the proceeds at the closing, they are sent directly to the Qualified Intermediary. The exchanger thereafter has 45 days in which to identify potential replacement properties and 180 days, or the date upon which the exchanger has to file his or her tax return for the year in which the exchange was initiated, to complete the purchase of the replacement properties. When the replacement property or properties are located, the exchanger enters into a contract to purchase same, and thereafter uses the exchange funds to complete the purchase. This, in very basic form, is the structure of a delayed tax deferred exchange.

6. What kind of due diligence should I do when picking out a qualified intermediary?

An exchange is basically a sale just like any other sale and a purchase just like any other purchase, however, you must work with a qualified intermediary before you start your exchange.Tax deferred exchanges are normally structured as one of four variants: simultaneous, delayed [Treas. Reg. 1.1031(k)-1(a)], reverse [Revenue Procedure 2000-37], and build-to-suit. In the case of a simultaneous or delayed exchange, the exchanger first enters into a contract to sell the relinquished property or properties. Contrary to popular belief there is no “exchange contract” for a delayed exchange. The exchanger enters into a contract that they would normally use if they were not structuring the transaction as an exchange. However, the addition of an exchange cooperation clause is recommended to secure the cooperation of the buyer or seller of the relinquished property or replacement property, respectively.A person or entity that is not a disqualified party [Treas. Reg. 1.1031(k)-1(g)(4)(iii)], usually a Qualified Intermediary, thereafter assigns into the rights, but not the obligations of the contract. This assignment creates the legal fiction that the Qualified Intermediary is actually swapping one property for another. In reality, the exchanger sells the relinquished property and purchases the replacement property from whomever he or she wishes in an arms length transaction. There is absolutely no requirement that an exchanger actually “swap” properties with another party.In addition to the assignment of contract, there must be an exchange agreement entered into prior to the closing of the first property to be exchanged. The exchange agreement sets forth the rights and responsibilities of the exchanger and the entity acting as a qualified intermediary, and classifies the transactions as an exchange, rather than a sale and subsequent purchase. In addition, the exchange agreement must limit the exchanger’s rights “to receive, pledge, borrow, or otherwise obtain the benefits of money or other property before the end of the exchange period.” Treas. Reg. 1.1031(k)-1(g)(6). That is, the exchanger may only use the exchange funds to purchase new property, and to pay most expenses related to the sale and purchase of the properties.Once the exchange agreement and assignment of contract are executed, the exchanger sells the property; however instead of collecting the proceeds at the closing, they are sent directly to the Qualified Intermediary. The exchanger thereafter has 45 days in which to identify potential replacement properties and 180 days, or the date upon which the exchanger has to file his or her tax return for the year in which the exchange was initiated, to complete the purchase of the replacement properties. When the replacement property or properties are located, the exchanger enters into a contract to purchase same, and thereafter uses the exchange funds to complete the purchase. This, in very basic form, is the structure of a delayed tax deferred exchange.