The Purchase Process

Scroll down for a step-by-step guide to buying real estate in New York City.

We’re by your side every step of the way.

Step 2: Search

Step 3: Offer Process

Step 5: In Contract

Step 6: Final Walk Thru + Closing

Step 7: Congratulations! Now what?

Step 1

Get Pre-Approved

TIME FRAME: 1 - 5 Days

If you’re a CASH buyer, skip to Step 2

Be Prepared

Buying in New York City requires confidence. So you need to work with local lenders active in this market.

Why get Pre-Approved before searching?

You need to understand what you can afford

Serious, pre-qualified buyers have the advantage in competitive situations

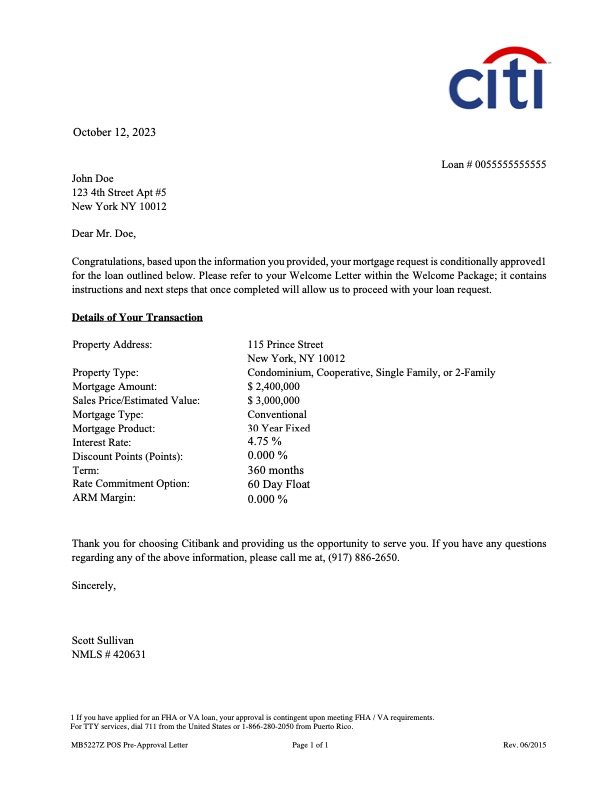

Pre-Approval Letter

A Pre-Approval Letter (PAL) is a 1-page letter that lays out your budget, which allows us to search and buy with confidence. A PAL states their terms and how much a lender is willing to loan you for your new home.

The 4 Factors

In determining your eligibility, Lenders consider these 4 factors:

FICO Credit Score

Debt to Income (DTI) Ratio

Assets for Downpayment and post-closing liquidity

Loan to Value (LTV)

Lenders

Mortgage Banker vs. Morgage Broker

Both are “lenders”. They are experts actively underwriting loans in the NY City real estate market.

Both offer different types of mortgages ("products"). Mortgage Bankers work for their respective banks. Mortgage Brokers, however, can surf all products from the big banks to smaller private lenders. Brokers are more flexible best if you have unconventional income or want to get aggressive knowing your options.

Connect with a lender today to understand your spending power, current interest rates, and the different products — and a PAL.

Get Pre-Approved

View our list of known mortgage pros in the New York City real estate market.

Mortgage Calculator

Most purchasers put down 20% of the total purchase price, which means they are financing 80% In general, the more you put down, the lower the Interest Rate.

You can estimate your downpayment and monthly costs here:

Step 2

Search

TIME FRAME: 30+ Days

Let’s find your next home together.

Streamline your search with the Compass platform. Communicate and schedule tours with ease.

With so many listings and different ways to communicate, Collections help us save, organize, and share the listings you like — all in one place. It's easy to collaborate in real-time and make decisions together.

- Introducing -

Search Criteria

- Curate your Collection based on what you want and where you want to be.

Collaborate

-

Invite your spouse, parents, designer, etc and discuss listings.

⭐ Mark your Favorites

📍 Request a Tour for those you love

🚫 Remove the ones you don't Monitor

- Track listings prices and availability. Know the market.

Real estate's only visual workspace.

Compass is a Real Estate Broker and has all listings in our database.

Digital Tour Sheets

We Have You Covered

Compass is first and foremost a broker. But we are also a tech company.

Our tech like helps us plan tours together.

Mobile AppsDownload our Compass Real Estate App

Step 3

Offer Process

TIME FRAME: It Varies

Stand Out. Be Prepared.

With over 2,000 deals closed since the mid-1990s, we have systems to help you.

New York City is a hyper-localized market. So, despite the national headlines, supply is down and demand is up. The most serious buyers are prepared and aggressive. To get you the deal you want, it’s critical that you have your offer paperwork and your team in place.

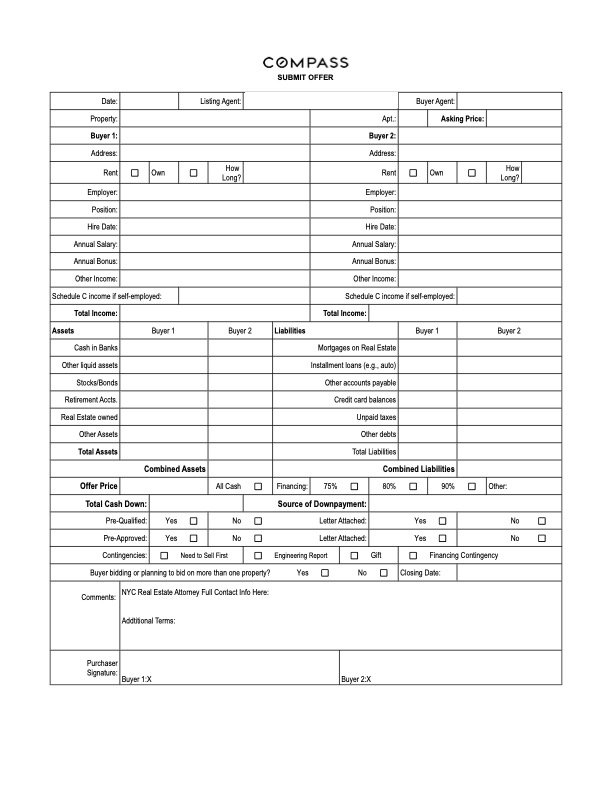

Be Prepared

Once we find a home you want, we use this Financial Spreadsheet as an "Offer Form". It's an industry-standard 1-pager sellers agents use to compare all offers. We need to convey your buying power and preparation whether or not it's a competitive situation. To Sellers and their agents, it's all about risk management.

It's not just about who has the most money, but who is the most prepared and easy to work with. That means having a team in place with a reputable attorney and an active NY City lender for your Pre-Approval (if applicable).

We gather this paperwork to help get your offer accepted:

Real Estate

Attorney

Dream Team

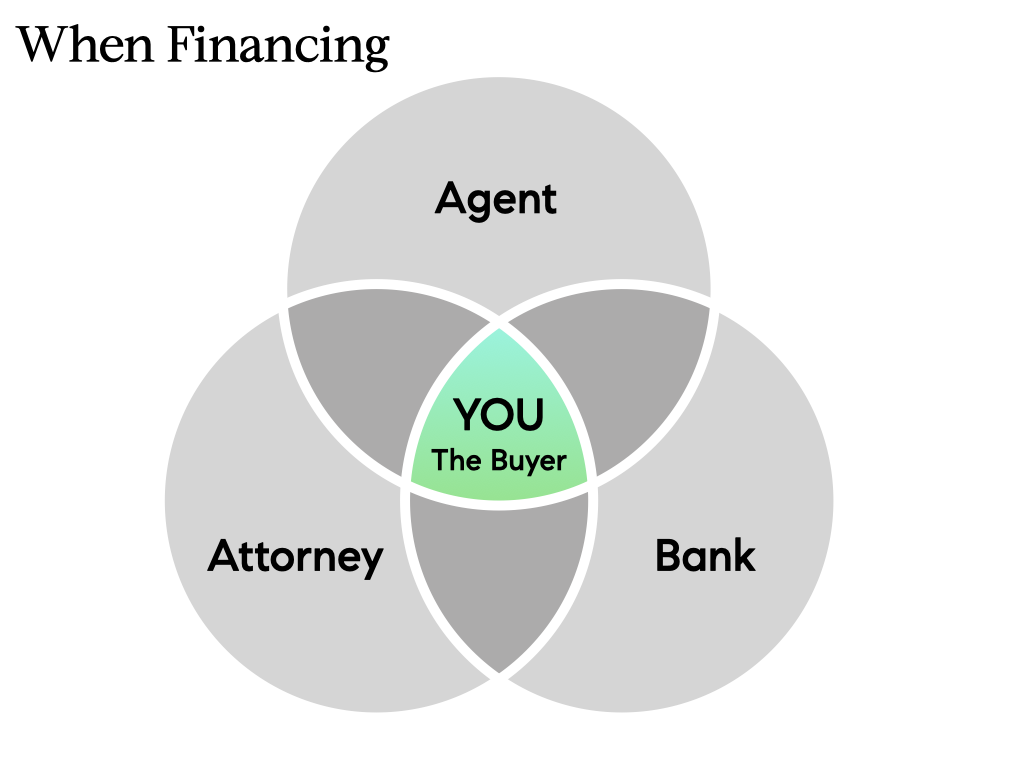

Buying a home can feel like a daunting process. It is likely the most expensive and emotional purchase of your life. But the right team in place makes dreams come true.

Whether you’re Financing or All Cash, your team of experts will work together to close the deal you want.

Purchase CEMA

Before making an offer on a Condo or Townhouse, ask your agent about “Purchase CEMA” savings (not applicable on Cooperatives since they are not “real property”)

The “Purchase CEMA” is used by savvy real estate experts to save money when buying or selling property in New York. Scroll down to learn how we can drastically reduce your closing costs and save you thousands of dollars. This money can used toward your other closing costs. Don’t leave money on the table.

Offer Strength

The 3 Offer Types

Here are the 3 types of offers that get deals done on a daily basis — ranked strongest to weakest.

1

All Cash

Cash is King. This is the most compelling offer because Sellers aren’t affected by banks, contingencies, or overall delays. Cash purchases close faster and are less risky.

Cash does not mean sellers will take less, so beware of lowball offers in competitive situations.

2

Non-Contingent

Not everyone has cash. Non‑financing contingent offers let buyers compete with all‑cash bids — and win. Waiving all contingencies makes you truly competitive with all‑cash buyers.

The risk here is that if the appraisal is below the contract price, the bank may require you to cover 80% (sometimes 100%) of the gap. For a $100,000 delta, that can mean an extra $80,000 down. That’s why New York City lenders matter.

3

Contingent

Contingencies protect buyers, but increase sellers’ risk. First-time buyers often choose financing contingencies because they worry about appraisal shortfalls and lack funds to cover the gap. Other common contingencies include inspections and needing to sell a current home. Sellers dislike contingencies, though deals can still close with them.

Closing Costs

Know Your Budget

Closing Costs. Do you know yours? If not, use these calculators to crunch important numbers.

Step 4

Accepted Offer, Inspection, Sign Contract + 10% Deposit

TIME FRAME: 5 - 10 Days

Attorney Review Period

Once your offer is verbally accepted, your real estate attorney dives in. They ensure your contract is ironclad and the purchase is clean. That way you feel confident executing and wiring your 10%.

After the seller's attorney sends over the first version of the contract, your attorney will review and markup contract language with the Seller’s attorney. This will be pretty straightforward. Most contracts start with the same New York Contract of Sale form, however, the Riders are nuanced. Both parties then need to agree on the final contract terms and language.

Due Diligence

Your attorney will also review Due diligence materials. These are basically all documents available about the building and the unit if you’re purchasing a Condo or Coop. The goal of this step is to make sure you are not buying into any problems.

For example, after reviewing the building’s financials, it might become apparent the maintenance needs to increase materially. Perhaps the board minutes show an assessment is being planned because the roof is on its last legs. Maybe your Brownstone has a violation that needs to be cleared.

While this is going on, you’ll also complete the inspection, should you choose to do one. Since the inspection happens before you sign the contract, you don't need an inspection contingency. If it uncovers big problems, you simply walk away from the deal. If everything checks out, it’s full steam ahead.

Inspection

Buyers should conduct a Home Inspection immediately upon getting their offer accepted. The Inspection report is a variable of Due Diligence. We’ll review your report together thoroughly before you sign a contract.

Inspectors are licensed experts who deliver detailed reports. The inspector will examine the many aspects of the home for defects, including faulty appliances, windows, lead paint, and even termites. They deliver a .PDF report complete with images and notes on important issues. We use this info to decide whether you want to proceed with the transaction or renegotiate terms. All of this will be included in the contract before you sign.

Sign the Contract

& Wire 10% Deposit

Assuming Due Diligence checks out, your attorney will advise you to eSign the contract and wire your deposit.

The customary contract deposit in New York City is 10% of the purchase price. So on a $1 Million purchase, you will be required to wire $100,000 with your signed contract. Typically the seller’s attorney coordinates a wire to their escrow account where your money sits until Closing. At Closing you pay the bank or the balance of your deposit.

The Seller will not countersign a contract until the deposit clears in their attorney’s escrow account. But once the funds clear and the seller counter signs, you are IN CONTRACT!

FAQs

-

Yes. Sellers typically show until the contract is Fully-Executed.

Buyers can walk away from a deal before a contract is signed for a number of reasons:

• cold feet

• find a different property

• come to an impasse on the contract

• discover something in due diligence

• or just not sign the contractIt's also possible for other offers to be considered for backup. There are no guarantees until a contract is Fully executed.

Money talks and if someone makes a higher, more compelling offer, the seller may switch.

That's why it's important to move fast and have a good real estate attorney on your team.

-

Your attorney instructs you on all of this.

Your attorney will send you a Final Contract and written Wire Instructions.

Your 10% Contract Deposit must be wired to the Seller’s Escrow Account the moment you sign the Contract.

The Seller will countersign after

(1) they receive your signed contract and

(2) your 10% wire hits the attorney’s escrow account.

-

Assuming everything goes well during the Due Diligence Process, contract negotiation, and property inspection, you can sign the contract to purchase the property, and the seller agrees to sell it to you under the same terms.

You will also be required to provide a 10% deposit at this stage. When the seller countersigns the contract and returns a copy to your attorney, the property will be considered "in contract," and you will be officially purchasing the property.

Congratulations!

Step 5

In Contract

TIME FRAME: 30 - 60 Days

Your journey to close.

It’s time to secure your financing or the cash to purchase. Condos & Coops require paperwork. Brownstones do not. We need approvals and a clear to close.

Each transaction is different. Condos and Cooperatives have Purchase Applications, which require paperwork, credit checks, and reference letters, and Board Approval. Townhouses and Brownstones have no paperwork — hooray!

If you are financing, you need to secure the best mortgage which includes underwriting. Once you have a Clear to Close, the Attorneys coordinate your Closing.

Secure a Mortgage

If you are financing, now is the time to shop Lenders. You are officially In Contract, which means banks take you seriously. Lenders will compete for your business. See what they can offer.

If you shop your contract, get competing quotes within 10 calendar days — to be extra safe.

PRO TIP: You have a 14-Day Window to Run Credit Safely.

Optimal shopping period time frames are built around FICO scoring models so get all of your Pre-Approvals done in 2 weeks. FICO should give you a 14-day grace period for mortgages. In other words, FICO treats similar loan-related inquiries within 14 days of each other as a single inquiry.

Purchase App

Purchase Applications are part of buying in a Condominium or Cooperative. You will need to need to submit a Purchase Application (also called a “Board Package”). We’ve got you covered and will help you with this paperwork.

Today, most Purchase Apps have online platforms where we upload PDFs. Ultimately, we’re compiling a lot of financial paperwork.

Common Requirements

-

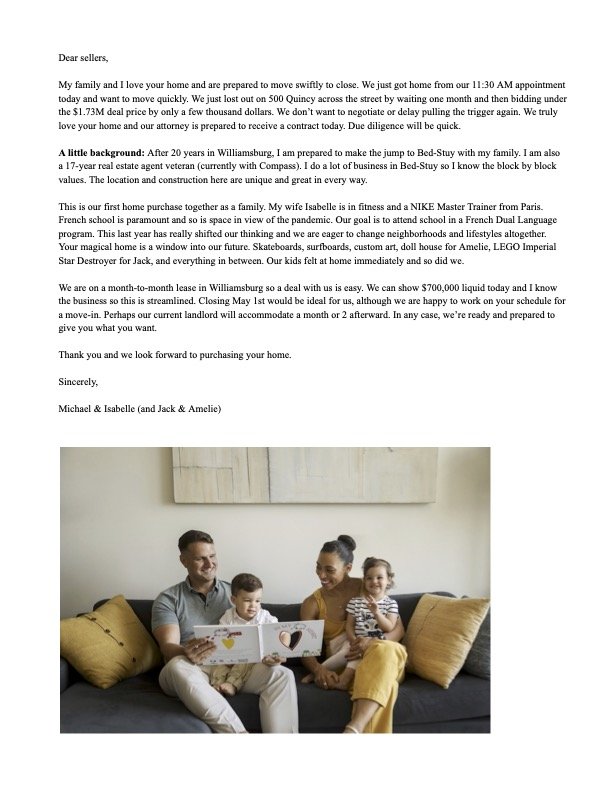

Most purchase applications do not require an intro letter but you should always include one. It’s your chance to introduce yourself and your application to the board. In addition to being a nice gesture, it also gives you the opportunity to explain anything quirky about your application.

It doesn’t need to be anything elaborate. Just a couple paragraphs with a quick background, why you like the apartment, building, neighborhood and thanking the board for reviewing your application. You can find a sample introduction letter here but make sure to make it your own. Boards see a lot of intro letters and if they think it's something generic that you copied, it can backfire. Add some quirky details about yourself to make sure it will stand out.

-

Every building is a little different but it’s basically a big form with everything the board could want to know about the deal - price, down payment, everyone’s contact information, your residence history, etc.

If a field doesn’t apply (like down payment in a cash deal), it’s best to put “N/A” so everything is filled in.

-

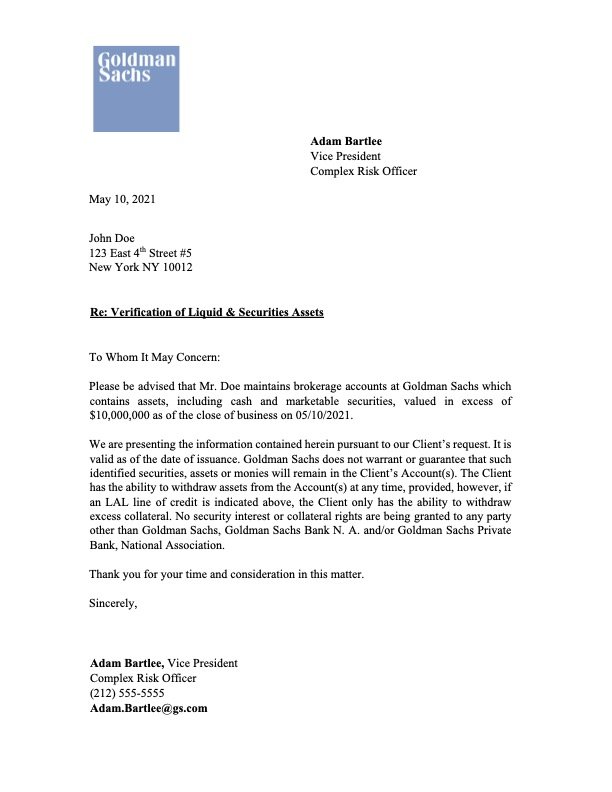

When you made your offer, you likely submitted a REBNY Financial Statement. For the board application, you’re doing that again but all of the numbers are going to be backed up and exact. There will also be a schedule where you’ll list out your holdings in more detail.

-

Financial Statements are account statements. Make sure to confirm how many months of statements the board wants to see. Usually, boards want to see up to the three most recent for each account.

Most applicants just have bank, brokerage and retirement accounts but anything you’re including in the Financial Statement needs to be backed up here.

A common complicating asset is other real estate because there is a lot to document - your ownership, its value, any mortgage, and other carrying costs like property taxes. Usually, a property tax bill (which shows property taxes and ownership), a mortgage statement, and Zestimate will suffice. If the property is rented out, the lease should be provided

There are a lot of best practices here that will save you some headaches

Circle or highlight account balances. This makes it easy for board members to follow along and pay attention to the right numbers.

Circle or highlight the contract deposit. One of your assets will be the 10% deposit you put down when you signed the contract. Show the board the withdrawal on your account statement.

Organize the statements from most to least liquid. Start with cash and end with retirement or real estate. When in doubt, look at the financial statement which is generally listed in decreasing liquidity.

What do you do with life insurance? This is always tricky. If you have a regular term life policy, that does not go on the financial statement. The board only cares about another kind of life insurance policy called “whole life” which has a cash value and kind of a savings or retirement account.

Remember everything needs to be backed up, including your income so make sure your salary matches your employment letter, your dividends match your tax return, your rental income ties to your lease, etc.

-

Make sure to sign your tax returns. Most people file their taxes electronically so never sign them but if you look near the bottom of the second page, you’ll find the signature line and boards will send your returns back if they’re not signed.

Also make sure your W-2s are originals from your employer, not the W-2 form that’s included with your tax return.

-

You’re going to be asked for up to four kinds of reference letters - personal, professional, landlord and bank. Personal and professional reference letters should be unequivocally positive and say that you’re without a doubt the best applicant the board could ever ask for.

Listing agents and boards love to nitpick on the personal and professional reference letters but there are a few things you can do to help them sail through

All letters should be property formatted with letterhead. If your professional references can use their company’s letterhead, fantastic, but you can always use your own.

Personal reference letters can be about multiple applicants. Professional reference letters can only be about one applicant, obviously.

Don’t ask family members - it sounds obvious but people do it!

Get someone else to read them to make sure nothing can be misinterpreted as alarming.

Landlord and bank reference letters are more like factual statements in a standardized format. If you ask your landlord and bank for these, they should know what you’re looking for. A landlord reference letter basically says you’ve been a good tenant and the bank reference letter confirms your account details.

-

Every board purchase application will ask for an employment reference letter. It should have your position, hire date, salary and, if possible, any bonus.

Some employers are rigid about the information they’ll provide but having your previous bonus is helpful because it allows you to clearly document your income with one document. As an alternative, you can document your bonus with the relevant pay stub.

-

The easiest item on the list! Just ask your attorney for it and you’re done!

PRO TIP: Every contract includes the lead paint disclosure and you can use it for the purchase application’s lead paint disclosure too.

-

This a standardized form with all of the information you submitted to your loan officer. All you need to do is ask them for a copy. There is sometimes a line for you to sign so take a look for that.

-

The commitment letter is your lender’s final deliverable before closing. It’s basically them saying, “We have all of Bob’s documents, did the appraisal and checked every box. We’re ready to issue the loan.”

The only wrinkle here is you want the final commitment letter. Lenders often jump the gun and issue one before the appraisal is ready which is not helpful or what you want.

Always make sure to send your commitment letter to your attorney before anyone else. They will make sure it’s the final version which is especially important if you have a financing contingency.

Once you have the final commitment letter, all you need to do is sign it.

-

APPLICABLE TO CO-OPS ONLY

Aztech recognition agreements are one of the most confusing parts of a co-op purchase application because they need to be originals. For more info on what recognition agreements are, check out our dedicated blog post here but the gist is it’s an agreement between your lender, the co-op and you to figure out what happens if you fall behind on your payments.

Later in your loan application, your bank will overnight three copies. You’ll sign them and submit them with the purchase application when the co-op can also sign them.

Even if you’re using an online application system, original recognition agreements must still be submitted. Condos do not require recognition agreements because they are real property, not shares.

-

Every building’s purchase application has lots of miscellaneous forms to cover things like the house rules, their pet policy, lead paint, and bed bugs disclosures, etc. They look like more work than they are - just sign and you’re done!

-

You’ll get nickel and dimed for a few fees when you submit your purchase application.

Normally there is an application fee, credit check fee, move-in fee, and a few miscellaneous others and they usually need to be paid by bank checks.

A bank check is picked up in person and deducted from your account when issued so it’s guaranteed to go through.

The purchase application itself should specify how fees need to be paid. If anything is unclear, confirm with management first. If you can’t get a straight answer, go with a bank check. A bank check will always work, a personal check may not.

Coop Interview

Once the Management Company and Coop Board have processed your paperwork, it’s time for the famous Board Interview. Some are In Person, but most are on Zoom today.

Power of Attorney

If you cannot — or will not — be present for your Closing, coordinate Power of Attorney (POA) with your real estate lawyer ASAP.

POA, also known as a “limited power of attorney”, is easier. POA grants your attorney-in-fact the ability to coordinate, sign, and authorize every single document for your Closing.

Since the pandemic, many sellers choose to skip the traditional in-person Closing. POA needs to be notarized with witnesses.

Scheduling the Closing

In New York City, Real Estate Attorneys schedule all closings. Your attorney will coordinate with the other attorneys, i.e., the seller’s attorney, any bank attorneys, the title company, etc. to schedule a closing.

Real estate agents do not schedule closings. We are sidelined and forced to watch things play out among attorneys. We occasionally get called back in to corral certain parties, but in general attorneys handle all aspects of your Closing.

Step 6

Final Walk Through

+ Closing

TIME FRAME: DEPENDS

How it works, what to expect, and what to do.

Whether this is your first real estate closing or you are a seasoned veteran, here’s how to prepare for your real estate closing.

First things first: In New York City, you need a “Clear to Close” from the bank if you’re financing. Then, or if this is a Cash purchase, Real Estate Attorneys schedule the Closing.

1. Schedule Closing

In New York City, real estate attorneys coordinate every aspect of your closing. They handle everything from payoff amounts and closing costs to wrangling all the parties involved. Brokers are generally NOT included in this

Once we have the In the day or two before closing, we revisit your future home for a Final Walk Through. This is to ensure it is being delivered per the terms of the contract. We address any issues that may pop up and confirm with the attorneys.

2. Closing Costs

Be prepared. In the week(s) leading up to your Closing, make sure your attorney shares a Closing Statement with you to confirm all of your Closing Costs down to the penny.

REMEMBER: The balance of your downpayment is part of your closing costs.

3. Final Walk Through

Your agent will arrange this with you and the Seller’s side.

Prior to closing, we will arrange a walk-through of the property. Per the terms of your contract, the house must be delivered “broom clean”. Our final walk-through of your new home is to inspect its condition.

This is your opportunity to ensure all agreed-upon inspection items have been completed, the condition of the home hasn’t changed from when you signed the contract, and all contractual items are in or have been removed from the premises.

Walk Throughs should last no more than 1 Hour.

4. Your Closing

Here’s what you need to prepare for the big day!

WHAT TO BRING

Be sure to bring the following for your big day:

BANK CHECKS

Your attorney will confirm amounts and payees unless you’ve already wired a full amount. In that case, your attorney will cut checks on your behalf.

I.D.

Make sure to bring a form of government-issued identification for the closing agent to verify you are, in fact, you.CHECKBOOK

Bring your checkbook to be safe.

FULLY CHARGED PHONE

Just a reminder. You may need to look up something online or search your email.

THE CLOSING TABLE

Closings are usually held at a related law firm office conveniently located for all parties. Everyone enters a conference room and sits around an oversized table.

Most closings will include some or all of these transaction parties:

Seller(s)

Seller Agent

Seller Attorney

Buyer(s)

Buyer Agent

Buyer Attorney

Bank Rep

Closing Agent

Title Company

1 - 2 HOURS

Closings typically take 2 hours or less if everyone is on time and everything goes smoothly.

There are three stages of the closing:

The first two parts pertain to transferring the real estate from the seller to the buyer.

STAGE 1: This includes all the documentation

STAGE 2: Accounting for the transfer.

STAGE 3: If you are taking out a morgage, you will need to complete the third and final part, paying for the home. This portion will contain the majority of documents and disclosures required by your lender.

KEYS

Once all the documents have been successfully signed and all money dispersed, you are now the proud new owner of the home! This will also be a good opportunity to ask the seller any additional questions you may have about your new property.

It is also a good idea to exchange contact information in case questions arise during the move-in process.

Set Up New Accounts

After you close, you will need to set up all new accounts. Be careful not to do this before closing — without the Seller’s permission or coordination.

Get Started

Be sure to call all of your service providers prior to or on the day of closing.

-

USPS

Change your address online:

https://moversguide.usps.com/mgo/disclaimerLinked to Your Address

• Public School

• Private School

• Dentist

• Doctor

• Magazines -

Property Registration

Housing Preservation & Development.

https://a806-pros.nyc.gov/PROS/mdRInternet.html#createAccount

-

You should already have homeowner's insurance lined up, but if you don't be sure to check out this list of providers using these keywords "best homeowners insurance company NYC with flood coverage":

NOTE:

Some banks require you to pay 1-Year upfront. It's added protection to additional monthly insurance payments. It can come as a bit of a shock.... but it makes sense from a liability standpoint. -

https://a836-citypay.nyc.gov/

https://www.govone.com/nycefile/Account/Logon

-

Water - DEP

DEPhttps://a826-amr.nyc.gov/mydepaccount/Electricity - ConEd

https://www.coned.com/en/contact-usGas - National Grid

https://www.nationalgridus.com/NY-Home/Default.aspx -

I recommend figuring out your SmartHome system and then which security system is the most compatible.

I have ADT, which is fine, but if you have a Smart Home, figure out which services work with your hub. ADT kinda works with Amazon Alexa, but Google Nest is all-in-one, and Alexa works seamlessly with Ring Alarm doorbells and cameras. You can also check out SimpliSafe, Wyze (great supportive tech like light programmable switches while on vacation), Alarm.com and Frontpoint (stand-alone).

-

Here are 3 Internet providers you should contact to see if they service your address -- and if they have any promotions:

Verizon FiOS

(800) 225-5499Spectrum (formerly Time-Warner)

(855) 640-0893Optimum

(866) 347-4784

Step 7

Closing.

Now what?

FEEL GREAT.

CONGRATULATIONS!

You closed on your new home. You're living the dream. Please share your amazing experience with the world on Google!

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

We live in a digital world and your review will help other home buyers.

Please click the our Google Business page and leave a quick 5-Star review like our other happy clients!